VAT in Bahrain| Synopsis of VAT in Bahrain Easy Learning

- May 1, 2019

- Posted by:

- Category: Tax

VAT in Bahrain

Bahrain is a country which has Petroleum production accounted for 11% of its GDP as per the available reports. It is the long – term vision of the country to shift this dependency from oil-based revenue to non-oil-based revenue, hence the applicability of VAT in Bahrain has been introduced.

The Kingdom of Bahrain is to become the third of the six Gulf Cooperation Council (GCC) member states to implement VAT in Bahrain . This follows the Unified VAT Agreement for the GCC states that was signed in 2016. GCC (Gulf Co-operation Council) countries have agreed ‘in principle’ to the GCC VAT Agreement to levy VAT (Value Added Tax) in the region. As per this agreement all the GCC countries were supported to implement VAT on or before 1st January 2019. VAT in UAE and KSA has already implemented it on 1st January 2018 and Bahrain from 1st January 2019. The other GCC countries also expected to implement the VAT without much delay.

VAT in Bahrain an overview

- The National Bureau for Revenue is the authority responsible for the administration and implementation of VAT in Bahrain.

- The VAT Decree – Law no. 48 is the law in Bahrain regarding Value Added Tax. The VAT law was officially approved and published it on October 2018.

- The VAT Executive Regulation of the VAT Decree Law which contain detailed rules was published it on December 2018.

- All the companies with sales more than 5 million BHD should Register for VAT in Bahrain with National Bureau for Revenue (NBR) before 20th December 2018.

- All the companies with sales more than 500,000 to 5 million BHD should Register for VAT in Bahrain with National Bureau for Revenue (NBR) before 20th June 2019.

- All the companies with sales more than 37,500 to 500,000 BHD should Register for VAT in Bahrain with National Bureau for Revenue (NBR) before 20th December 2019.

- If the annual turnover of a taxable person doesn’t reach the VAT Registration threshold, then in that case they can still opt for VAT on a voluntary basis. Click the link to learn in our video how to who can apply for Voluntary Registration are what are the advantages

You can also have a glimpse to our video on How to register for VAT in Bahrain?

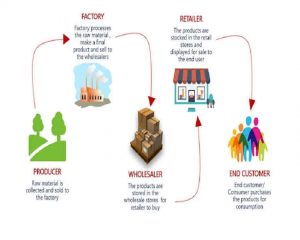

How does VAT in Bahrain work?

VAT in Bahrain: VAT is applicable in almost all the sales and services in Bahrain. Some of the categories are retail and wholesale sales, hotel sales, consultancy etc.

Structure of VAT in Bahrain?

| Purchases

in BHD |

Taxable Sales Invoices

in BHD |

Tax on Purchases | Tax on Sales | Tax Payable | ||

| Excl. of Tax | Incl. of Tax | |||||

| Producer | – | 100 | 105 | 0 | 5 | 5 |

| Factory | 105 | 200 | 210 | 5 | 10 | 5 |

| Wholesaler | 210 | 300 | 315 | 10 | 15 | 5 |

| Retailer | 315 | 400 | 420 | 15 | 20 | 5 |

| Consumer | 420 | 20 | ||||

| 20 | ||||||

Assumption: Both raw material and finished goods have same percentage of VAT i.e. @ 5%

What are the Categories of Goods & Supplies under VAT in Bahrain?

The supply of goods and services are subject to VAT in Bahrain at a Standard Rate of 5% unless they are specifically subject to Zero Rated Supplies or Exempted supplies from VAT. You can also find the link of a examples of standard rated goods by sector in National Bureau of Revenue (NBT)

Zero-rated supplies are those kinds of supplies which are taxable at a rate of 0%. Zero – Rated Supply means that VAT will not be actually charged on the supplies, but the supplier can still claim the input tax that has been charged on incurred expenses while making the supply.

Exempted supplies are those kinds of supplies which are exempt from VAT and are also referred as non-taxable supplies. So no VAT is charged on supply of such goods or services hence, no input tax can be claimed for those supplies.

How is VAT calculated?

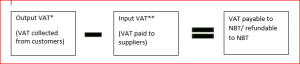

*Output VAT: Output VAT is the value added tax calculated and charged on the sales of goods and services.

** Input VAT: Input VAT is the value added tax added to the price when goods are purchased or services are rendered.

Are you looking for VAT Services in Bahrain?

Emirates Chartered Accountants provides one of the best VAT Services Bahrain possessing a wide array of services. Even before the implementation VAT of Bahrain we have been serving our UAE clients since the inception of VAT in UAE from 1st January 2018 with over 1000 happy customers.

What do we offer?

- VAT Registration

- VAT Training

- VAT Implementation

- VAT Return Filing

- VAT Consultancy

- Accounting for VAT Compliance

|

For TAX Service in Bahrain Mr. Bichin +973 3619 8998 |

For TAX Service in UAE

Mr. Navaneeth +971 55 889 2750 |