- November 12, 2020

- Posted by:

- Category: Tax

VAT Audit in Bahrain

VAT Audit in Bahrain is a process by which the National Bureau for Revenue (NBR) will assess whether the VAT payer complies with the Bahrain VAT Law. As you all know, all the VAT payers could be subject to VAT Audit in Bahrain by the National Bureau for Revenue (NBR)

The NBR also looks into the accuracy of the VAT Return filed by the VAT payer for each VAT period and assess whether the net VAT liability declared is correct.

NBR audit can cover one or more tax periods and the VAT Return filed. During the VAT Audit in Bahrain, the NBR scrutinizes all the data and documents that are to be maintained as per the Bahrain VAT Law

What is the frequency of VAT Audit in Bahrain conducted by the NBR?

The frequency of VAT Audit in Bahrain varies from one taxpayer to the other. The NBR takes into consideration the expected risks on VAT collection in industry and decides on the frequency of audit.

The VAT Audit in Bahrain depends a lot upon the size and complexity of a business. The track recorder of the company while complying with his obligations as per the Bahrain VAT Law is also a factor considered by NBR.

Company in VAT refundable position could also be frequently audited.

The NBR will not reassess the VAT liability of a VAT period which has already been assessed. If it finds new information about a previously assessed VAT return, then it will audit the relevant VAT period again and determine the new VAT liability.

How does NBR conduct VAT audits?

The officials at the NBR might visit the premises of the company to conduct an audit. However, they may also conduct a VAT audit remotely. In this case, NBR sends a request to the company for the documents or data required for the audit. It specifies a deadline to furnish the requested information and documents.

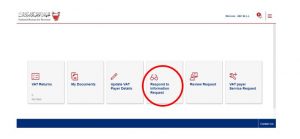

You can view the information request from NBR in the Login portal at the website of NBR from my documents or by clicking the icon “Respond to information request”.

The information asked by NBR can be provided in the Login portal at by clicking the icon “Respond to information request” and uploading the documents and writing down the proper answers to the questions asked by the NBR.

A screenshot of the Login portal can be viewed below:

In the case of onsite audits, the NBR might inform about the visit in advance. The NBR might provide a notice to the company informing him about the expected start date of an audit and all the records that the VAT payer should make available with him for conducting the review. This is done in order to allow the VAT payer sufficient time to prepare the relevant records and to ensure that the relevant employees are available at the time of VAT audit.

However, the NBR might perform an unannounced audit, if they suspect tax evasion or any other serious crime from the taxpayer.

What are the powers of NBR during the VAT Audit in Bahrain?

The NBR conducts the VAT Audit in Bahrain to ensure the overall compliance of the business with the Bahrain VAT Law and executive regulations. It ensures the validity of transactions, its completeness and accuracy and all disclosures in the VAT return filed. In order to assess the same, the NBR might perform the following procedures:

- The NBR may request access to the books of accounts, records and a soft copy or hard copy of other documents maintained such as TAX invoices, Bank statements, Contracts etc.

- The NBR may take a sample of the taxpayer’s databases, accounting system and any other files in order to validate the accuracy of the transactions disclosed in the VAT returns.

- The NBR can also take or request samples of any goods found within the means of transport or the places used for the supply of goods.

- The NBR can also enter into the taxpayer’s work premises or any other place of business to carry out inspection.

- It may access any means of transport used for the freight of goods.

- The NBR can take all necessary steps to gather the evidence to examine the extent of the tax- payer’s compliance.

- The NBR may question the employees of the taxpayer about the taxpayer’s business affairs and procedures.

- The NBR can also close a taxpayer’s business as a precaution while carrying out the inspection.

- It records any violations noticed during the on-site visit and prepares reports.

How to avail the results of VAT Audit in Bahrain conducted by the NBR?

If during the VAT Audit in Bahrain, the NBR comes across non-compliance with the Bahrain VAT legislations, it will issue a VAT assessment decision to the taxpayer. The assessment notice shall be sent via mail or through the post. It may also be viewed in the “My documents” or “Respond to information request” icon at the portal.

The VAT assessment issued will include the following:

- The facts, information and legal basis of the reassessment.

- The value of the Net VAT due after conducting the audit and the difference with the original return filed.

- The value of any penalties if applicable.

- The date of payment of the net VAT due, if any.

If a taxpayer does not agree with the NBR assessment, then he has the right to object the assessment to the VAT appeal Review Committee within 30 days from the date of notification of the assessment.

Our Tax Experts in Emirates Chartered Accountants Group Bahrain believe in a proactive approach to tax advisory services with a cost-effective and tailor-made option that is preferred by businesses all over. Our team of professionals is well versed with the Bahrain VAT Law as well as the UAE VAT Law They are also equipped with practical experience of implementing VAT in UAE and VAT in Bahrain.

Our wide range of services includes:

- VAT Registration

- VAT Training

- VAT Implementation

- VAT Return Filing Service

- VAT Consultancy

- Accounting for VAT Compliance

We’d be happy to support you – Call us!

| For TAX Service in Bahrain

Mr. Bichin +973 3619 8998 |

For TAX Service in UAE

Mr. Navaneeth +971 55 889 2750 |